Our RUGGED & AGILE SUPPLY CHAIN survey was instructive. Here are the main results …

MAIN RESULTS OF THE RUGGED & AGILE SUPPLY CHAIN SURVEY

- The health crisis has highlighted the need to guard against other hazards in the future

- However, the maturity of companies is uneven in this area.

- Progress remains to be made on this front, but also on the ability to seize opportunities (integrate an acquisition, open new channels, adapt to the development of new products and services) … to return more quickly to an acceptable situation

- Many levers have been used by companies such as inventory adjustment, the versatility of teams, more frequent S&OP as well as means of anticipating hazards (risk management, business continuity plans)

- Companies will continue their efforts in this direction, without forgetting to review their information systems.

- In terms of new technologies, respondents find artificial intelligence promising to make their Supply Chain more robust & agile.

Methodology

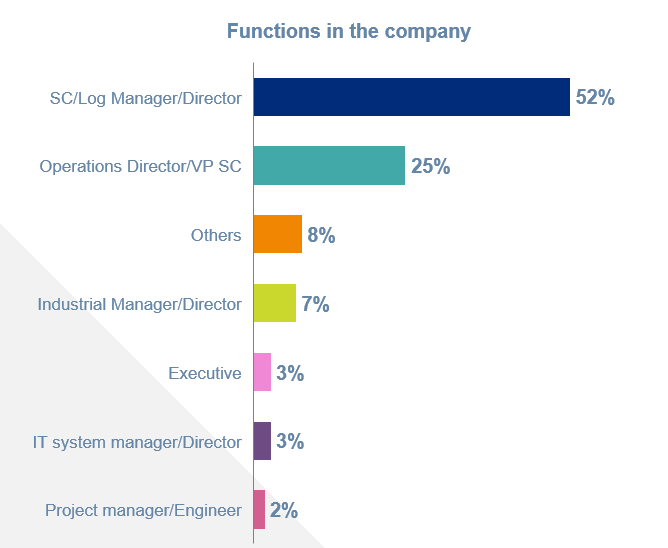

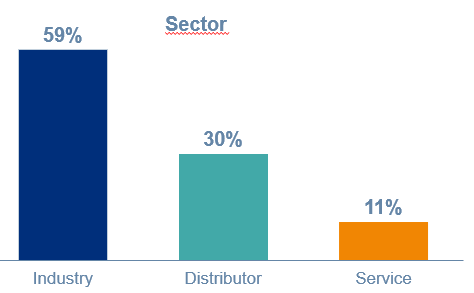

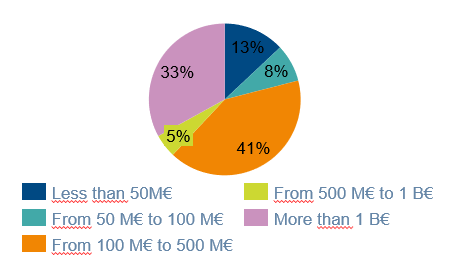

From November 22 to December 15, 2020, we sent a questionnaire to decision-makers in the Supply Chain and business leaders. This survey was relayed by France Supply Chain. We received 61 actionable responses.

The respondents are 77% of decision makers in the Supply Chain. Most of them work for manufacturers, mid-size companies or large groups with turnover of over € 100 million.

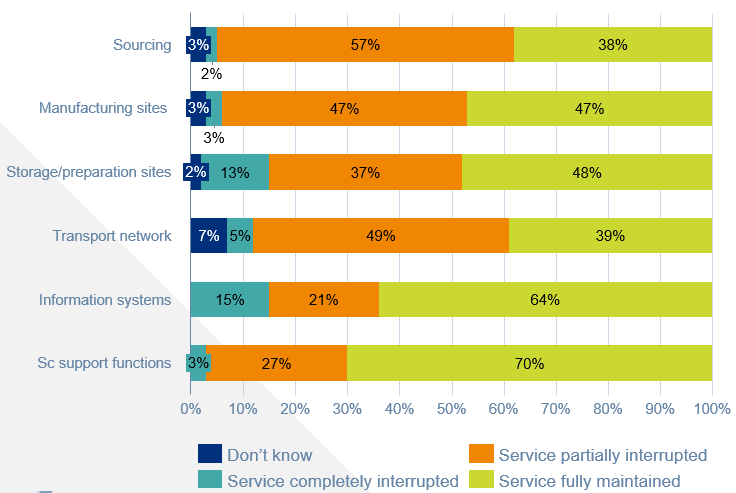

The weak links in the Supply Chain

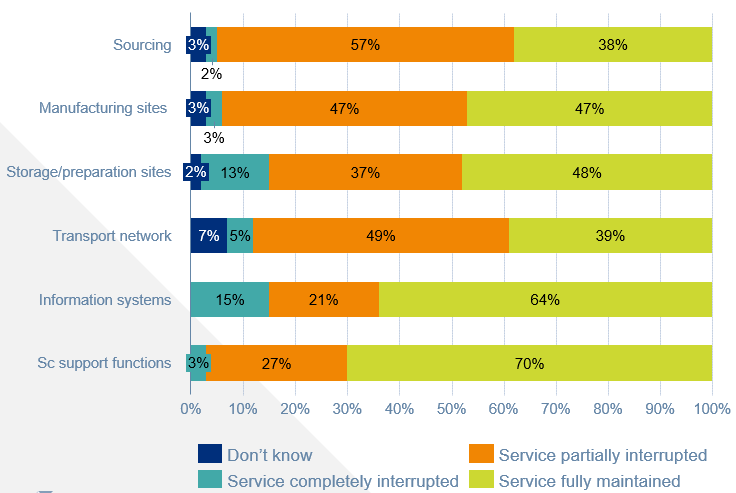

We questioned decision-makers on the ability of their Supply Chain to continue to serve customers despite major hazards of certain links (such as supplier failure, strike, etc.). Thus, sourcing, production sites and storage / preparation sites appear to be the points of the Supply Chain most vulnerable to severe hazards. Conversely, the support functions of the Supply Chain (ADV, forecast service, supply, etc.) seem the most resilient with service fully maintained for 70% of respondents and only 3% completely interrupted in the event of major contingencies. Likewise, the S.I. seems to resist shocks as well with 64% of service fully maintained, 21% partially but still 15% totally interrupted.

Few “Don’t know” (DK) responses to this question overall, the maximum being 7% for transport. This suggests that it is a very disturbed and difficult function to apprehend, with also 49% of service partially interrupted.

Less resilience upstream of the Supply Chain

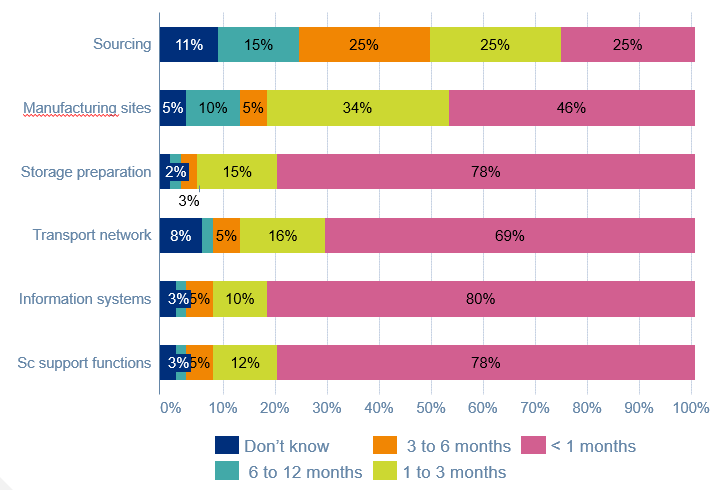

The next question related to the time needed to regain an acceptable level of service and economic performance following a major hazard in a component of the Supply Chain.

With the exception of sourcing and production, the majority of respondents say they are very responsive in terms of their ability to regain an acceptable level of service and economic performance. It is therefore the upstream Supply Chain that seems the least resilient.

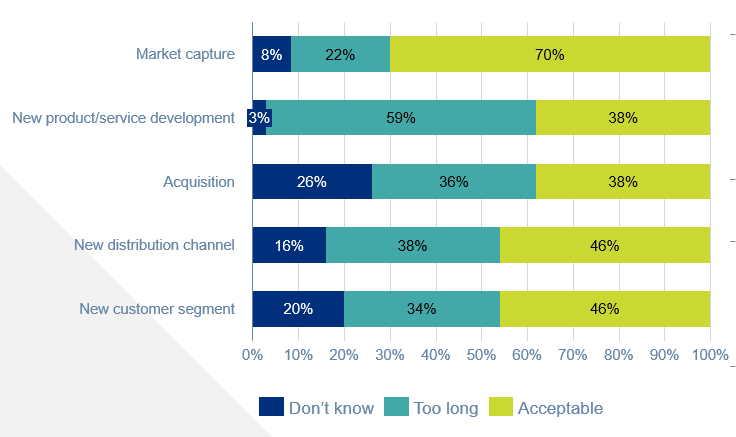

Seize opportunities, a less well anticipated hazard

If the respondents have already thought about how to protect their Supply Chain in the face of major hazards, the ability to adapt it to seize opportunities seems to be a less extensive field of study since the rate of NSP rises to 26% . Adapting to market capture covers the best responsiveness. However, the most desirable improvement in responsiveness concerns the introduction of new products / services since 59% of respondents believe their response time is too long. Likewise, the integration of an acquisition also seems less successful, as does the opening of new distribution channels.

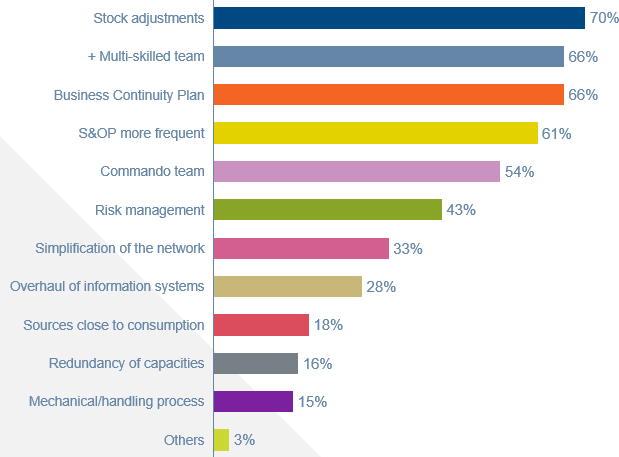

Stocks as the first adjustment variable

Asked about the levers used to make their Supply Chain more robust & agile, the respondents highlighted the adjustment of stocks (finished products, components, raw materials, etc.) to 70%. Then comes the flexibility of the teams, through their increased versatility as well as the implementation of business continuity plans (BCPs). In addition, as was often mentioned elsewhere in the testimonies of companies to deal with the health crisis, the implementation of a more frequent S&OP (Sales & Operations Planning) is another important lever (61%).

Other actions related to risk management such as the appointment of “commandos” and risk management teams were carried out by half of the respondents. The simplification of the network, the redesign of the IS to facilitate switchovers, the reconciliation of sources of consumption areas, the redundancy of capacities in the networks and the review of the balance of manual and automated processes have been less active.

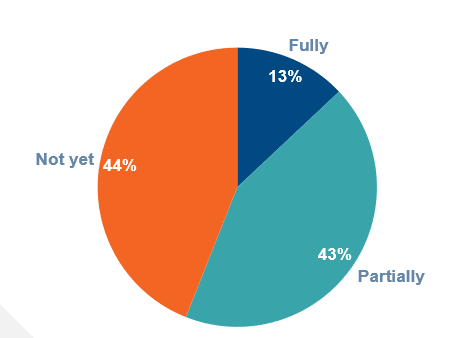

Objectives still to be set in terms of the robustness / agility of Supply Chains

Almost half of the respondents did not set targets for the robustness and agility of their Supply Chain (48%). This finding suggests that the robustness & agility of the Supply Chain may not yet be a major focus for these companies.

A large margin of progress

When we ask respondents who have set objectives in terms of the robustness & agility of their Supply Chain if they believe they have reached them, again, a large margin of progress appears since only 13% of companies declare that they have fully achieved them. achieved their goals. 43% say they have partially achieved them and 44% not at all. Setting goals for the robustness and agility of your Supply Chain is therefore a good start but not a guarantee of success!

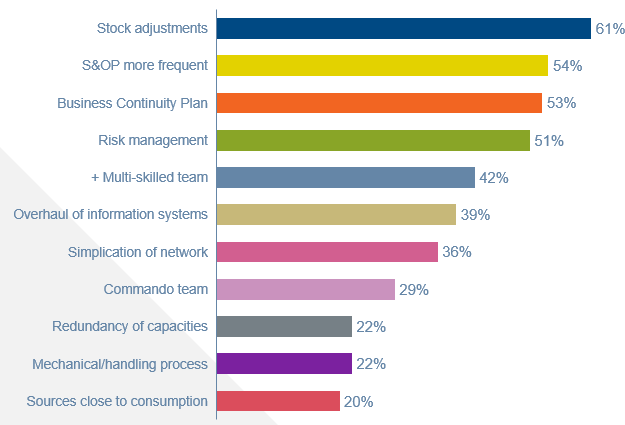

More frequent S&OP as leverage, in addition to inventory adjustments

Compared to the previous question on the levers already activated, this question on the levers envisaged makes it possible to have the areas of improvement estimated for companies. Inventory adjustment remains in the lead at 61% and therefore has yet to reach its full potential. More frequent S&OP is a wish for 54% of respondents, as is putting in place or improving business continuity and risk management plans (respectively 53% and 51% of responses). In addition, working on the versatility of teams remains an important lever for 42% of respondents. We should also expect plans to redesign IT systems and simplify logistics networks (more than a third of respondents).

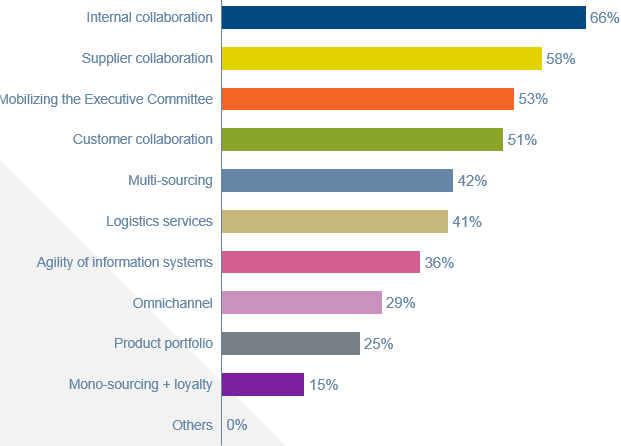

General management and collaboration projects

Asked about other potential levers for improving the robustness & agility of their Supply Chain, respondents highlighted the importance of collaboration (internal with other functions, external with suppliers and customers) . It is the big winner of the levers “” external “to the Supply Chain function: unity and the best synchronization being the force in the face of adversity (industrial side as well as distributors).

In addition, mobilizing the CODIR for faster and more impactful decision-making was a lever underlined by more than half of the respondents. While 42% of respondents wish to diversify their sources and 41% to adapt their logistics services. In addition, the agility of information systems is a subject for more than a third of respondents. Finally, omnichannel is only mentioned at 29% overall (but this figure climbs to 39% for distributors).

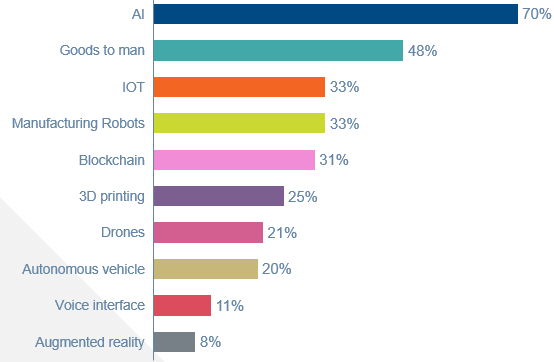

AI as the most promising technology to make Supply Chains more robust & agile

We also asked respondents to tell us the technologies that seemed to them the most promising and likely to contribute to more robustness / agility of their Supply Chain.

Artificial Intelligence (Big Data, Machine Learning, etc.) is by far the technology considered to be the most promising for contributing to the robustness and agility of the Supply Chain (approved by 72% of distributors and 69% of manufacturers). Goods to Man preparation is put forward by 48% of respondents (47% of manufacturers but only 39% of distributors who prioritize Blockchain at 44% in 2nd position, while Manufacturers place production robots in 3rd position, at 44% too).

The Internet of Things, for its part, appears in third place overall, but with only 28% of distributors and 31% of manufacturers (tied with 3D printing).

Still a few ways missing to move forward

There is still progress to be made in terms of the means to complete the efforts to improve the robustness and agility of Supply Chains. In fact, 60% of manufacturers say they lack certain means, as do 56% of distributors. In terms of resources, what is most lacking revolves around:

- information systems (more suitable and flexible solutions, but also available IS resources),

- dedicated internal resources and skills (project manager, etc.),

- budget and time,

- as well as the will / involvement of management.

- In more disparate ways, insufficient technological and technical resources (inventory drones, AI, blockchain, automated control towers, etc.) but also organizational / process (more frequent S&OP, better visibility of demand) are mentioned. client) and method.

TO KNOW MORE:

SUPPLY CHAIN AT THE TIME OF THE RESILIENCE

SUCCEED IN YOUR POST COVID-19 REBOUND